Permit Expediting Financial Perspectives: Navigating the Regulatory Landscape

Permit Expediting Financial Perspectives: Navigating the Regulatory Landscape

There are times some of our clients choose not to use us due to financial reasons, and although they usually decide to bring us on anyway, the need to explain permit expediting financial perspectives is apparent. Recently, an article by Kevin Choquette of Fident Capital outlined the impacts the slow-down in construction lending is having and sourced reasons for the slow down. Choquette cited the basic reasons for the slow-down in lending for construction as Basel III, Dodd-Frank, and the Consumer Protection Agency (Choquette, Kevin. “Slow for Construction.” Western Real Estate Business October 2016: pages 36-37. Print Article ). While the complexities of these regulatory financial components don’t intersect with permitting directly, they do indirectly affect how you will choose to work with a permit expediter. From the permit expediting financial perspectives, these factors decide if a firm will get a permit expediter at all! A more long-term ramification of stringent financial regulations as they pertain to permits is without an expediter the developer will most likely end up going over costs and timeline for the entirety of the project. The last, and perhaps most important, impact permit expediting financial perspectives has is how it affects the client’s market share.

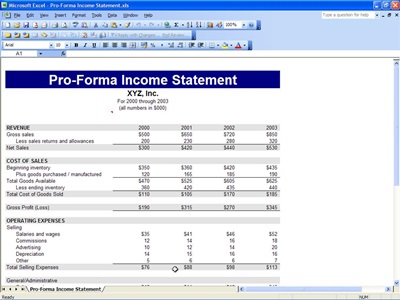

“I wish I could use a permit expediter on this project, let me tell you, but we just can’t afford it on this one,” a client tells me over the phone. In the back of my mind, I realize this customer would love to use Permit Advisors but his construction loan doesn’t extend to cover those costs or the head of the development allocated funds elsewhere. The problem with not including permit expediting financial perspectives in your construction costs is, often times, approvals for larger projects will extend beyond your construction start date. This ends up costing everyone on the team more money anyway, and soon folks start backing out of the project. When permit expediting financial perspectives are included on the pro forma the project will be able to meet challenges as they occur during the permit process, and are approved on-time. So, when I get the call from a client that a particular project is too small or isn’t funded for permit expediting solutions I have compassion for the project manager as often they will end up doing the permits themselves. I also anticipate a call further down the road as they usually end up wanting Permit Advisors anyway.

Looking at the life of your project; the lack of proper permit expediting financial perspectives is the time an untrained professional undertaking the permit process will need to get the approval. Through no fault, other than ignorance, doing the permit without an expediter can cost weeks or even months in review times. By jeopardizing the construction start date you are paying an expensive daily rate for delays, and once you miss a construction start date you can assume the construction will fall behind. You will also need to factor in final inspections after construction that can lead to more delays as things need to be changed. The final monkey wrench in the process after late construction starts is when tenants will be able to move into their spaces. If they aren’t able to move in quickly the grand opening can consist of partially available businesses which affect the revenue and thereby your profits. Another aspect to consider with regard to tenants and late dates is their requirement for co-tenancy. They may renegotiate their lease if there are stipulations citing any changes or delays allowing them to do so.

The final aspect of permit expediting financial perspectives is how they impact a client’s market share in the local region. With a proper perspective and inclusion of permit expediting solutions a client is able to strategically enter a market and profit as soon as possible. The lack of a permit expediting financial perspective results in delays and costs, as outlined in the previous paragraph, and affects how the community will perceive the business. For example, working in a high-density area will be more complex-even for simpler projects-and without an expert the business may walk away from the project altogether. When the client walks away from a project this affects their market share in the region and opens it up to competitors who did plan for the complexities and hiccups.

Navigating the regulator landscape for commercial construction is by no mean feat a tool architects, tenants, brands, developers, and landlords need to use are permit expediting solutions. Including a positive permit expediting financial perspective safeguards the investment of working on the project by mitigating long-term construction loan costs, delays, and client market shares. At Permit Advisors I am often getting phone calls requesting help putting together a healthy permit expediting financial perspective to ensure everyone has an efficient, quality, and cost-effective experience getting their business open. I extend you this invitation as well, call me anytime to get a consultation at (310) 275-7774

About: Permit Advisors, Inc. is a nationwide permit expediting, entitlement, and consulting firm based out of Beverly Hills, CA. We have established relationships with municipalities nation-wide and implement time as well as cost-saving strategies to efficiently complete projects. We provide a project management team to ensure every aspect of the project is given specific attention while maintaining open communication between the jurisdiction, consultants, and our clients. We serve retailers, architects, landlords, tenant coordinators, contractors, and franchisees nationwide in the hotel, retail, restaurant, mixed-use, multifamily, entertainment, grocery, and logistical plant development industries. Contact us today for a consultation at www.permitadvisors.com.